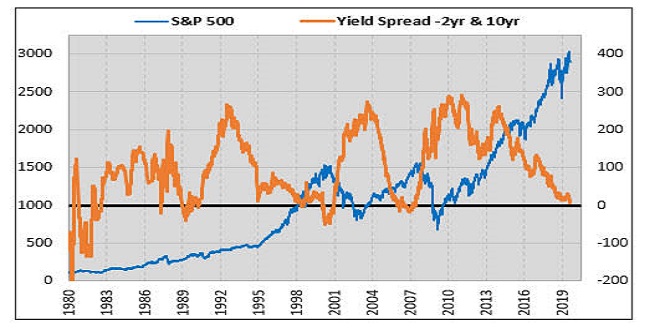

The global markets are in flux, and traders must monitor many macroeconomic signals that can affect their portfolios. One such signal is the yield curve inversion – when long-term interest rates fall below short-term interest rates. Yield curve inversions occur for several reasons, including uncertainty about economic conditions caused by external shocks or inflationary pressures.

As investors try to navigate these turbulent times, it’s essential to understand both the causes and implications of yield curve inversions – and what they mean for stock market performance over time. In this article, we’ll explore how yield curve inversions interact with stock market movements so that you have a better understanding of where the markets will go from here.

Overview of Yield Curve Inversions and their Relationship to Stock Market Performance

A yield curve is a graph that plots the relationship between short-term and long-term debt securities of the same credit quality. Yield curve inversions occur when the yields on short-term bonds exceed those on long-term bonds, and it has historically been a signal of an impending recession. The implications of yield curve inversions on stock market performance are significant, as they may directly affect investor sentiment and confidence.

Stock markets typically experience periods of volatility during yield curve inversions, which can lead to sell-offs and declines in asset prices. Despite this, investors need to recognise that stock market performance should be viewed as something other than an estimate of the economy’s overall health.

Instead, investors should pay attention to all the factors at play in the market to make informed investment decisions. To plot a yield curve, investors must know the various indicators and trends to help them understand what is happening in the markets.

Short-Term Trading Strategies for a Rising Yield Curve

When the yield curve is inverted, investors may be hesitant to continue buying stocks and instead may look for other opportunities to protect their portfolios. However, traders can use specific short-term trading strategies to take advantage of a rising yield curve.

One such strategy is the “short squeeze” technique. It involves identifying companies with high levels of short interest and buying shares in anticipation of a short squeeze. A short squeeze occurs when investors who have bet against a stock are forced to buy shares to cover their losses, causing the stock price to rise quickly. This strategy can be risky and requires careful research and analysis, but it can also lead to significant profits if executed correctly.

Another trading strategy is shifting investments towards defensive sectors, such as consumer staples or utilities, which perform better during economic downturns. Investors can also consider investing in gold or other commodities to hedge against market volatility during yield curve inversions, stated Sam Sutterfield, an Accredited Investment Fiduciary (AIF®) as well as the Co-owner of Elevate Wealth Management who brings close to two decades of industry experience to his firm. He has built a rich resume of experience in banking and investment advisory roles and has made it his goal to support clients in planning the best financial future. Sam enjoys time with his family and is an active volunteer in his community.

Mid-Term Investing Strategies for Flattening or Inverted Yield Curves

For investors with a longer time horizon, mid-term investing strategies can be implemented during flattening or inverted yield curves. One such strategy is to increase allocations towards value stocks and decrease exposure to growth stocks. Value stocks outperform growth stocks in economic uncertainty as investors seek stability and reliable dividends.

Investors can also consider diversifying their portfolios and including alternative assets such as real estate investment trusts (REITs) or high-yield bonds. These assets can provide a buffer against market volatility during yield curve inversions.

Long-Term Planning Implications of an Inverted Yield Curve

While yield curve inversions are often seen as a warning sign for the economy, investors must look at the bigger picture and not make rash decisions based on short-term market movements. When planning for the long term, investors should consider the underlying fundamentals of their investments and focus on diversification.

Furthermore, an inverted yield curve may provide attractive buying opportunities for stocks with solid fundamentals and a track record of weathering economic downturns. Investors should also be aware that yield curve inversions do not always lead to a recession, and the market can still perform well during these periods.

How Professional Investors Leverage the Power of Yield Curve Inversion Analysis for Maximum Return on Investment

Professional investors often view yield curve inversions as a valuable tool for understanding market trends and making strategic investment decisions. They use technical indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands to analyse the relationship between short-term and long-term bond yields.

Additionally, professional investors constantly monitor economic data releases, central bank policies, and geopolitical events that can impact the yield curve and stock market performance. By staying informed and leveraging their expertise, they can decide when to enter or exit positions during a yield curve inversion.

BESTCITYTRIPS

BESTCITYTRIPS